Disclaimer: This content is for educational and informational purposes only and does not constitute financial or investment advice. Investing involves risks, and you should always conduct your own research or consult with a financial advisor before making investment decisions. This post contains affiliate links, and I may earn commissions if you sign up through these links at no additional cost to you.

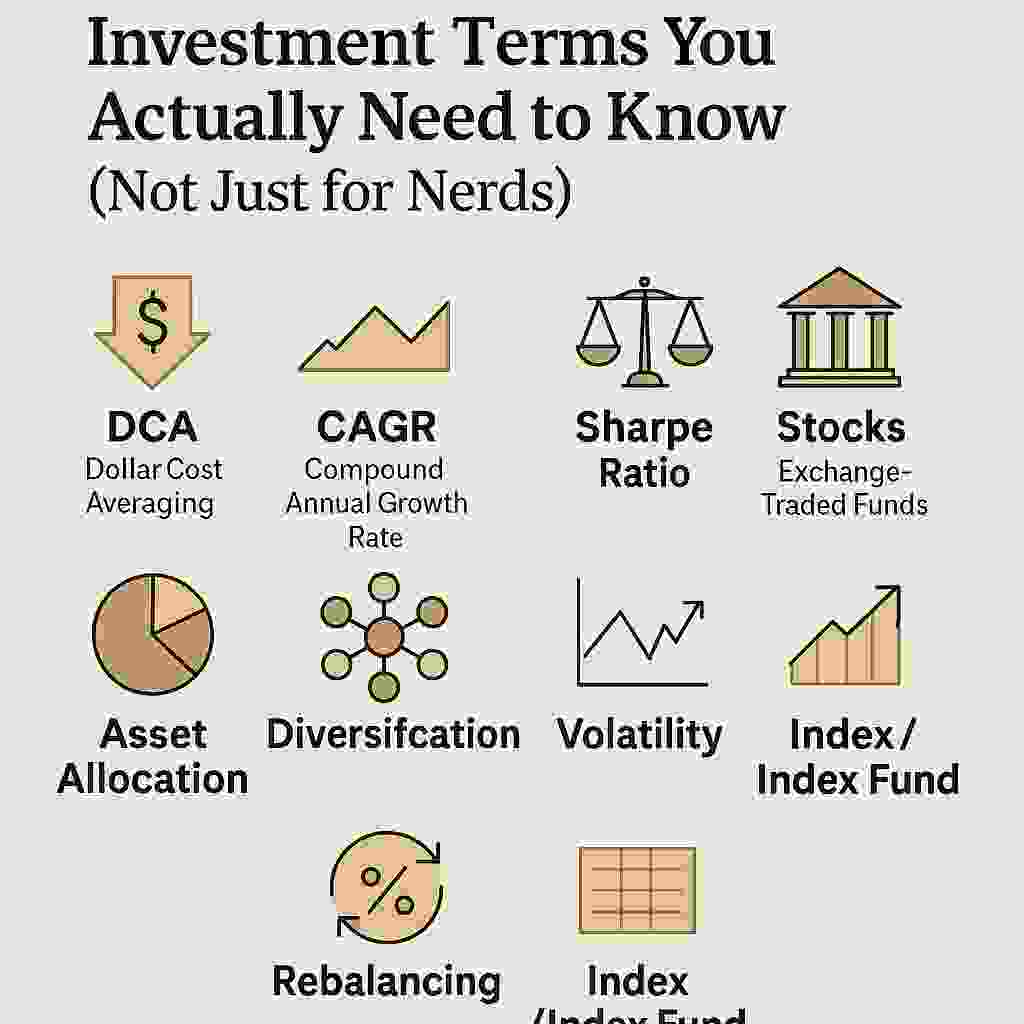

In our previous posts, we introduced our first investment bucket, consisting of QDIV (60%), UPRO (30%), and DBMF (10%). Today, we’ll explore portfolio rebalancing—why it matters, how to do it, and its practical effects on portfolio performance.

Types of Rebalancing Strategies

Portfolio rebalancing ensures your asset allocation aligns with your original investment strategy and risk tolerance.

1. Regular (Calendar-Based) Rebalancing:

- Typically monthly, quarterly, or annually.

- Easy to manage and schedule.

- Ignores market conditions, which may result in frequent or unnecessary adjustments.

2. Threshold-Based Rebalancing:

- Adjustments occur when asset allocations deviate beyond a set percentage (e.g., 5%, 10%, 20%).

- Responsive to market volatility.

- May require active monitoring and could lead to more frequent trades.

Methods of Rebalancing

- New Contributions: Adjusting your allocation by directing new money toward underweighted assets, minimizing transaction costs and tax implications.

- Existing Assets: Selling overweighted positions to buy underweighted ones, potentially incurring transaction fees and tax consequences.

Practical Scenario Analysis: Our Portfolio (QDIV 60%, UPRO 30%, DBMF 10%)

Let’s consider a hypothetical scenario over one year, assuming the following annual returns:

- QDIV: +8%

- UPRO: +30%

- DBMF: -5%

Initial investment: $10,000

- QDIV: $6,000

- UPRO: $3,000

- DBMF: $1,000

End-of-year values without rebalancing:

- QDIV: $6,480

- UPRO: $3,900

- DBMF: $950

- Total: $11,330

- New Allocation: 57.2% QDIV, 34.4% UPRO, 8.4% DBMF

Scenario Results:

| Strategy | Ending Allocation % | Rebalanced to 60/30/10 |

| No Rebalancing | 57.2 / 34.4 / 8.4 | – |

| Monthly | ~60/30/10 (Monthly adjustments) | Yes |

| 5% Threshold | 60/30/10 (Triggered at ~65/25/10) | Yes |

| 10% Threshold | No Trigger (57.2/34.4/8.4) | No |

| 20% Threshold | No Trigger (57.2/34.4/8.4) | No |

Insight: Monthly rebalancing or tighter thresholds (5%) help maintain the target allocation more accurately, potentially reducing volatility but possibly incurring higher transaction costs.

Important Note: If we do not rebalance, DBMF’s role diminishes significantly. Since DBMF is designed for diversification and volatility reduction, its shrinking allocation undermines its intended purpose. Regular or threshold-based rebalancing ensures DBMF maintains its allocation, continuously serving its role in managing portfolio risk effectively.

Long-Term Impact of Rebalancing (20-Year Simulation)

To understand how rebalancing impacts your portfolio in the long run, let’s examine the results from simulated 20-year scenarios with monthly contributions of $1,000 after an initial investment of $10,000:

| Scenario | CAGR (%) | Sharpe Ratio |

| No Rebalancing | 4.14 | 1.57 |

| Monthly | 4.54 | 1.38 |

| 5% Threshold | 4.46 | 1.39 |

| 10% Threshold | 4.59 | 1.39 |

| 20% Threshold | 5.01 | 1.39 |

Insight: Over a 20-year horizon, regular or threshold-based rebalancing generally enhances CAGR compared to not rebalancing. However, frequent rebalancing slightly lowers the Sharpe Ratio due to higher transaction frequency and associated volatility management.

Rebalancing Across or Within Asset Classes?

When adding more asset classes—like emerging markets or crypto—you face a choice:

- Across Asset Classes:

- Pros: Maintains overall risk exposure; reduces systemic risk.

- Cons: Might lead to selling appreciating assets early and buying underperformers too often.

- Within Asset Classes:

- Pros: Optimizes performance within each category; maintains targeted exposure per class.

- Cons: Can cause deviation from the overall asset allocation if one class significantly outperforms or underperforms.

Conclusion

Choosing the right rebalancing strategy depends on your investment goals, risk tolerance, and willingness to monitor your portfolio. Regular rebalancing is simple but less responsive; threshold-based rebalancing provides precision at the cost of complexity and potential transaction fees.

In the end, consistency and clarity about your goals matter most in managing your investments effectively.