Disclaimer: This blog post is for educational purposes only and does not constitute investment advice. Investing involves risk, including the possible loss of principal. Portfolio values can fluctuate and may decline. There is no guarantee that any investment strategy will be successful. The author may receive commissions from affiliated platforms if readers sign up through provided links. Always conduct your own research or consult a licensed financial advisor before making investment decisions.

Introduction

Most investors dream of growing their wealth safely over decades. But in practice, building a portfolio that performs well in bull markets and holds its ground during crises is far from easy. That’s why I believe in the concept of investment buckets: purpose-driven segments of your portfolio, each designed for a specific objective.

In this post, we’ll explore my first bucket: a long-term core growth engine powered by three ETFs:

- QDIV: Quality dividend-paying stocks

- UPRO: A leveraged bet on the S&P 500

- DBMF: Managed futures to hedge against market downturns

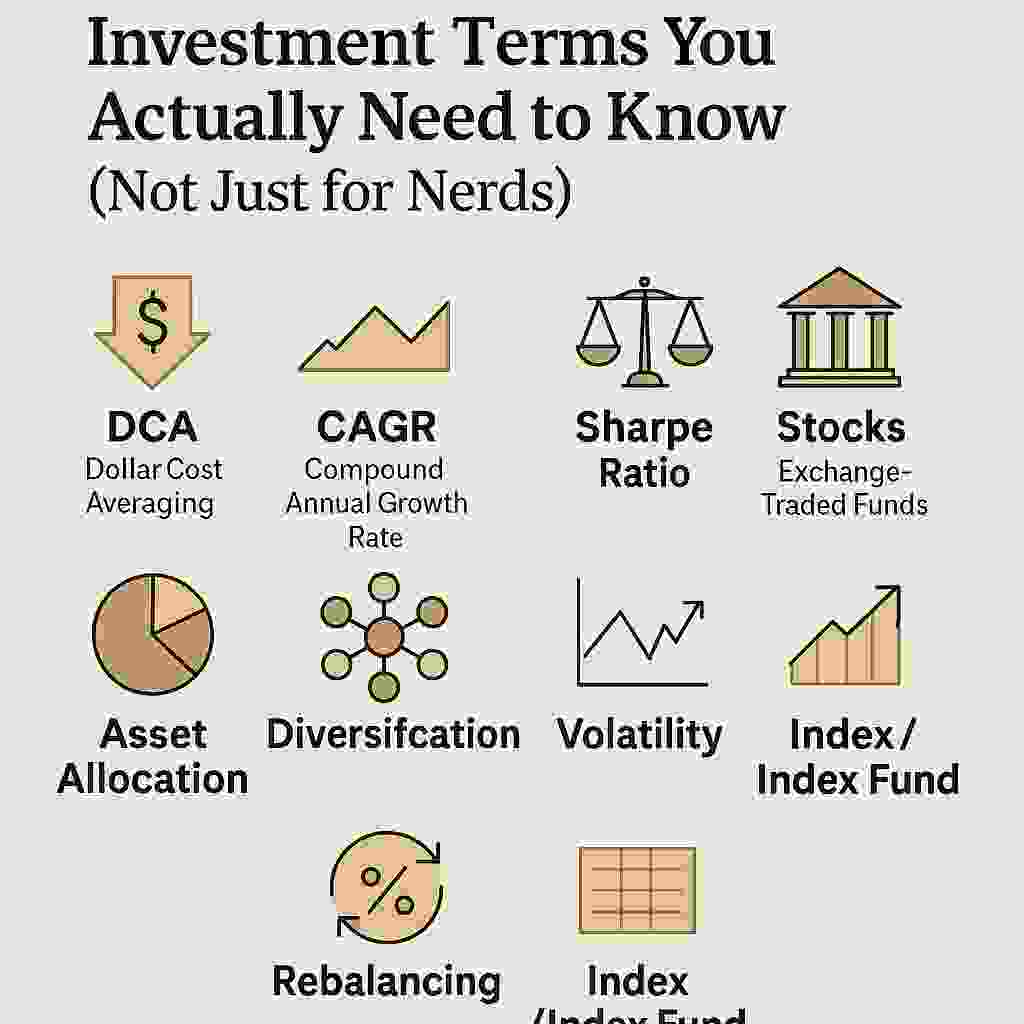

This bucket isn’t about chasing short-term gains. It’s built for consistent dollar-cost averaging (DCA) over the next 10 to 20 years, with an emphasis on rebalancing and discipline.

Let’s dig in.

QDIV: The Quality Dividend Backbone

QDIV (Global X S&P 500 Quality Dividend ETF) focuses on S&P 500 companies with strong fundamentals and a history of reliable dividend payments. It aims to combine the benefits of large-cap stability with income generation.

Over the past 10 years (simulated data):

- CAGR: 4.18%

- Volatility: 6.41%

- Sharpe Ratio: 0.65

What does this mean? QDIV grows modestly, but with low volatility and consistent payouts. It’s the kind of asset that doesn’t dominate headlines but helps you sleep well at night.

Why include it?

- It acts as a stabilizer when paired with more volatile assets like UPRO

- Quality companies weather storms better

- Dividends help smooth out returns

Adding UPRO: Supercharging Growth

UPRO (ProShares UltraPro S&P 500) is a 3x leveraged ETF that seeks to deliver three times the daily return of the S&P 500. It’s not for the faint of heart, but in the context of a balanced bucket, it becomes a powerful growth enhancer.

Simulated performance:

- CAGR: 21.64%

- Volatility: 21.04%

- Sharpe Ratio: 1.03

On its own, UPRO is risky. But when paired with QDIV, it boosts overall performance while keeping volatility in check. For example:

- A 70% QDIV / 30% UPRO portfolio significantly outperforms QDIV alone in bull markets

- Rebalancing helps lock in gains when UPRO rallies

UPRO turns your bucket from a slow crawler into a potential compounder — with the right discipline

Enter DBMF: The Risk Manager

DBMF (iMGP DBi Managed Futures Strategy ETF) is our stand-in for managed futures strategies. Unlike traditional long-only assets, DBMFs go long or short across asset classes based on momentum.

Simulated stats:

- CAGR: 3.84%

- Volatility: 4.73%

- Sharpe Ratio: 0.81

At first glance, it might look underwhelming. It doesn’t “rise” like stocks. But that’s the point:

- DBMFs thrive when markets are volatile or falling

- They zig when stocks zag

- Their value lies in diversification and protection

By adding 10-20% DBMF to a QDIV + UPRO mix, we smooth the ride and reduce drawdowns. It’s like installing an airbag in your sports car.

Rebalancing: When and How?

There are two main ways to rebalance:

- Cyclical: On a fixed schedule (e.g., annually)

- Threshold-based: When weights deviate beyond a set % (e.g., 5%)

In backtests, yearly rebalancing often strikes the best balance between simplicity and performance. Rebalancing too often may eat into returns; too rarely and your portfolio drifts off-course.

Another decision: how to rebalance.

- Rebalancing via new contributions (ideal) avoids taxes and trading fees, though any strategy to minimize taxes should involve consulting with a tax specialist

- Selling and reallocating should be a last resort, especially in taxable accounts

Discipline matters more than precision here. Stick to a rule and automate it.

What’s the Ideal Mix?

These are results from a scenario simulation over the past 10 years using synthetic return data. While useful for illustrating potential trade-offs, they are not predictions and come with no guarantees.

Let’s compare a few allocation strategies:

| Allocation (QDIV/UPRO/DBMF) | CAGR | Sharpe | Max Drawdown |

| 70 / 20 / 10 | ~8.7% | ~0.87 | Moderate |

| 60 / 30 / 10 | ~10.2% | ~0.91 | Higher |

| 50 / 30 / 20 | ~9.8% | ~0.95 | Lower |

Each mix has its tradeoffs:

- More UPRO = more upside and more volatility

- More DBMF = smoother ride, lower max drawdown

Personally, I’m starting with 60/30/10, rebalancing annually, and contributing monthly. It fits my risk tolerance and long-term goals.

Final Thoughts

This bucket isn’t a get-rich-quick scheme. It’s a tool designed for long-term compounding, using a smart blend of dividends, leverage, and diversification.

By consistently adding to this mix over the next 10 to 20 years, I aim to grow capital in a way that can withstand both booms and busts. Whether you adopt the same structure or tweak it for your needs, I hope this inspires you to think in buckets, rebalance with intention, and invest with a long view.